There are so many metrics and sub categories these days to evaluate a product, that every item on the shelf can find its niche to be the best. I once overheard a vendor exalt themselves as the fastest growing bread brand within the non-wheat, high protein subsegment - and I'm guessing that's a subsegment comprised of one other brand.

However a vendor decides to fill that hour in front of the buyer, it boils down to two questions:

(1) How profitable is the brand to the buyer and (2) How popular is the brand to the consumer?

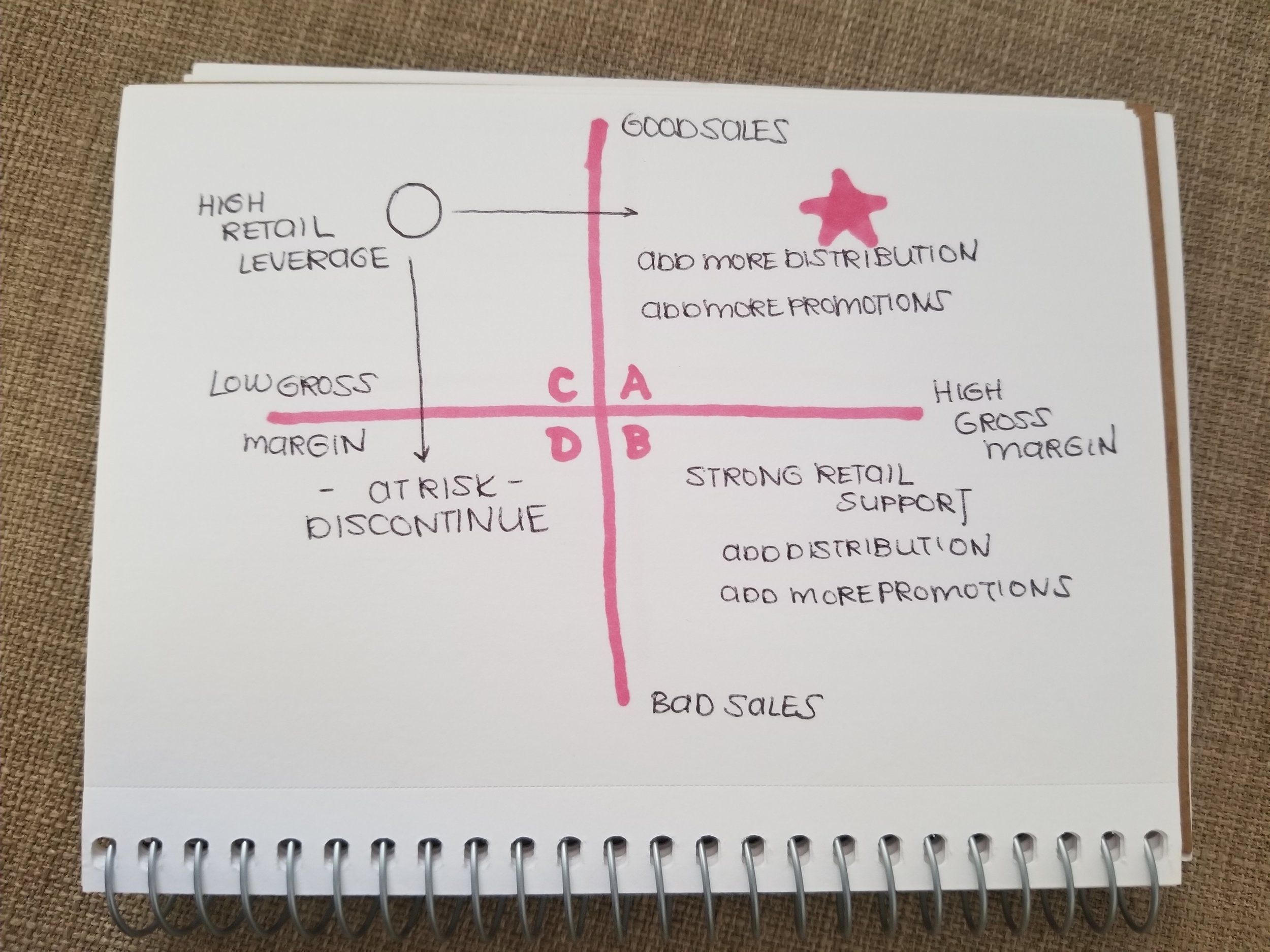

The Vendor Retailer Matrix

Quadrant A: Cash Cow for All - strong sales and strong margins

What to ask for: eye level placement, SKU expansion, best promotion opportunities.

Quadrant B: Vendor Leverage - weak sales and strong margins

This is where a retailer will lean in to support the brand, as the brand drives high profitability within the section.

What to ask for: better placement, strong promotion support

What to fix: brand needs to figure out how to resonate better with consumers - change in marketing tactics or formulation

Quadrant C: Retail Leverage - strong sales and weak margins

This is where a retailer has the most leverage and can control the fate of the brand. The brand is popular enough that a retailer has to carry them, but not profitable enough for them to invest extra shelf space and promotion opportunities for.

Brands - be prepared to offer an EDLC or OI to support a retailer's gross margin.

Quadrant D: A brand's existential crisis - weak sales and weak margins

The brand is at risk of being discontinued

What to fix: brand needs to figure out how to stay relevant with consumers and fix its costs.